Blog (2 of 4) What Do Rental Companies Care About?

If you’re a senior exec from a rental company (or any other company for that matter), what do you wake up in the morning thinking or worrying about? I asked one of my team to go through the latest annual reports of five rental companies of access equipment to do some ‘text mining’ and construct a spider graph showing the frequency of the most common terms. Now, I’m not going to reveal who the companies are, but they are five of the largest companies in the industry and some of them were at the conference.

In doing this, I’m making the assumption that their company annual reports are reasonable indicators of the strategic pain points that affect shareholder value. This is all publicly available data. In the interests of time, the five companies are grouped into one combined report for each year shown.

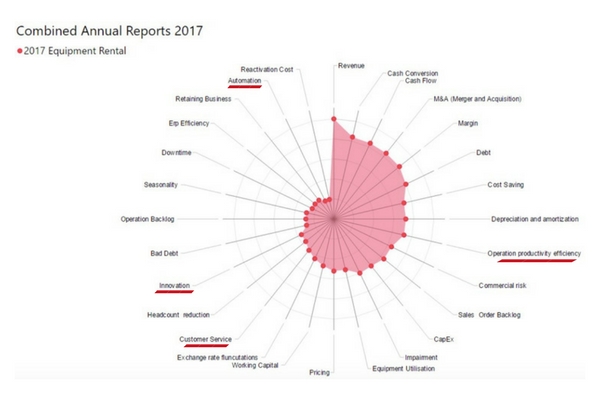

For company’s A to E, in 2017, the spider diagram looks like this:

Moving clockwise from the top position, you can see the top 28 data points. I’m not going to read too much into these figures without some further reflection, but I thought I would share the results with you at this stage. The first eight data points show the key financial references and that’s what you might expect in an annual report. I could argue that these eight are actually lagging indicators of what drives these businesses, because they’re outputs, not inputs. Moving clockwise from the first eight, I’ve underlined what I believe to be the leading indicators, in red.

The first one is Operational Efficiency at No 9, followed by Customer Service at No. 18, Innovation at No. 20 and Automation at No. 27. To better understand the future, it’s useful to have a look over our shoulders at the past, so here is the same exercise carried out on the annual reports of the same companies for 2012.

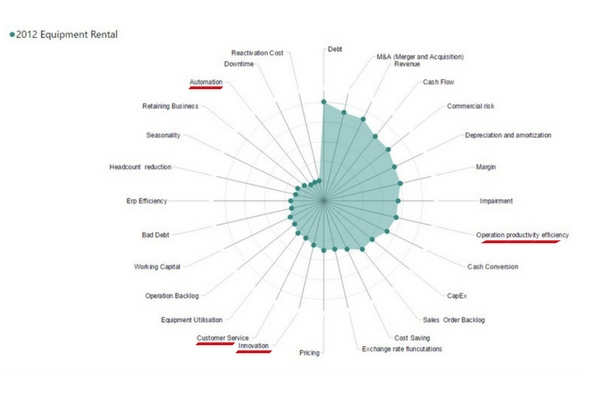

For companies’ A to E five years before in 2012, the spider diagram looks like this:

You can see that Operational Efficiency is No 9, Innovation is No. 16, Customer Service is No. 17 and Automation is No. 26.

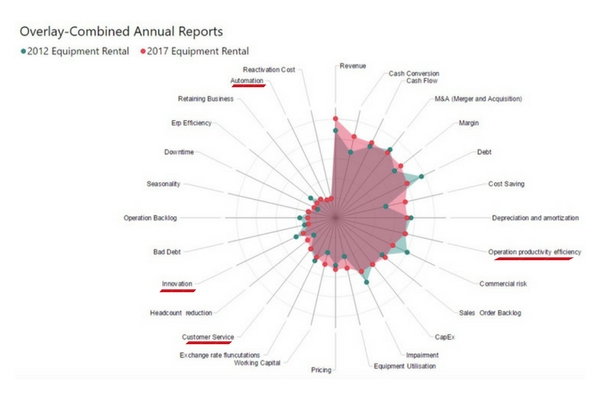

When we compare five years ago with the latest annual reports on an overlay, the conclusion must be that nothing much has changed.

The question these results raise is whether these rental company companies are pivoting around the things that really drive their business more effectively? Now, I as a rental customer, I don’t choose my access supplier based on researching comparative financial parameters, I chose them based on what I believe from their marketing and what I know about their reputation. How much are they likely to care about me as a customer? So, should these companies not be focusing more on their customer service?

Good customer service leads to TRUST and it’s customer TRUST that drives all the financial outputs that rental companies spend their time measuring to drive shareholder value.